Last updated: August 15 2024

CEI - A Bittersweet Tax Break for the Economic Times

Evelyn Jacks

The legislation to implement the Canadian Entrepreneur Incentive (CEI) was released on August 12 and while the provision has been improved from its debut in the April 16 federal budget, its effectiveness in offsetting the negative effects of the capital gains inclusion rate increases when an entrepreneur sells the shares of the company, may still be muted. The reality of the journey to a successful disposition is fraught with risk, as businesses are opening and closing at unprecedented rates. Another major flaw according to the CFIB, is the long list of entrepreneurs in important industries, who are still excluded.

What is the CEI? The Canadian Entrepreneur Incentive (CEI) reduces the taxes that new entrepreneurs will pay as a result of the government’s increases to the capital gains inclusion rate to 66 2/3% for all capital gains reported by corporations and trusts. In fact, the capital gains inclusion rate will be reduced to 33.3 per cent on a lifetime maximum of $2 million in eligible capital gains. The provision has not extended to trusts and will now be phased in by 2029, as opposed to the year 2034 in the original proposals.

What are the timelines? The disposition must occur after 2024 and the individual must be a resident of Canada throughout the year. The reduced capital gains inclusion rate will be phased in with $400,000 increments, rather than $200,000 increments as previously announced. The deductible amounts from taxable income on a future capital gain for the purposes of this incentive would be calculated as follows:

- 2025 - $400,000 less $266,667 =33.3 % capital gains income inclusion of $133,333

- 2026 - $800,000 less $533,333 =33.3% capital gains income inclusion of $266,667

- 2027 - $1,200,000 less $800,000 = 33.33% capital gains income inclusion of $400,000

- 2028 – $1,600,000 less $1,066,667 = 33.33% capital gains income inclusion of $533,333

- 2029 or a subsequent year - $2,000,000 less $1,333,333 = 33.33% capital gains income inclusion of $666,667

According to the government, entrepreneurs will have a combined full and partial exemption of at least $3.25 million when selling all or part of a business, which takes into account the $1.25  million Capital Gains exemption they would normally qualify for first. The next $2 Million would be calculated as above, the next $250,000 would be subject to a 50% inclusion rate available to individuals and after this the remaining capital gains would be subject to the 66.67% inclusion rate.

million Capital Gains exemption they would normally qualify for first. The next $2 Million would be calculated as above, the next $250,000 would be subject to a 50% inclusion rate available to individuals and after this the remaining capital gains would be subject to the 66.67% inclusion rate.

Who can claim it? The original budget provisions limited the CEI to qualified small business corporation shares used principally in an active business carried on primarily in Canada. Now the provision has been expanded to include all qualified farming and fishing property; and additional small businesses undefined in the news release issued by Finance Canada. There is no longer a requirement to be a founder of the business either.

Whose excluded? The tax break will not apply to professionals (including accountants, lawyers, notaries, physicians, mental health practitioners, health care practitioners, veterinarians, optometrists, dentists, chiropractors, engineers or architects). Unfortunately, nor will it be available for a business who principal asset is the reputation, knowledge or skill of one or more employees or a business that provides consulting or financial, insurance, real estate, or lodging services. Interesting. There’s more to know:

Also on the excluded list: Unfortunately, owners of short-term lodging or traveller services, those who operate services or facilities to cultural, entertainment and recreational interests won’t be able to make this claim. That includes the arts: producers or promoters of live performances or events, artistic skills for production or performances, preservation or exhibition of objects or sites of historical, cultural or educational interests. And yes, those who operate or provide services for sports or recreational pursuits are excluded too.

Qualifying properties. The legislation defines this a share of a qualified small business corporation, used principally in an active business carried on primarily in Canada, unless it is on the excluded lists above. Qualified farm or fishing properties may use the incentive as well. They were excluded in the original proposals.

The property must be a share, an interest in a partnership that is not less than 5% of the issued and outstanding shares that have full voting rights under all circumstances. In the case of a partnership the individual’s specified portion must be not less than 5%. Otherwise, the individual’s interest in the property must not be less than 5% of the total fair market value of the property.

Qualifying Participation. In addition, the individual must be actively engaged on a regular, continuous and substantial basis in the activities of the business for no less than 3 years. This is a change from the original rules which require a 10% interest and 5 years of active engagement. Even so, this poses an interesting dilemma if the acquirer appears sooner than the three year deadline; the assumption would be the CEI would not be available in that case.

Business Survival Rates. What is clear is that the CEI is complex and will require the help of qualified tax professionals. While it is good news for entrepreneurs who survive start up and growth challenges, the odds are not in their favor according to the government’s Key Business Statistics. Of businesses that began operations with 1‒4 employees, only 62.2% were still active after 5 years, 44.0% were still active after 10 years, and only 25.9% were still active after 19 years.

Larger enterprises fared better. Where those began operations with a workforce of 20−99 employees, 74.1% were still active after 5 years, 55.3% were still active after 10 years and 36.0% were still active after 19 years.

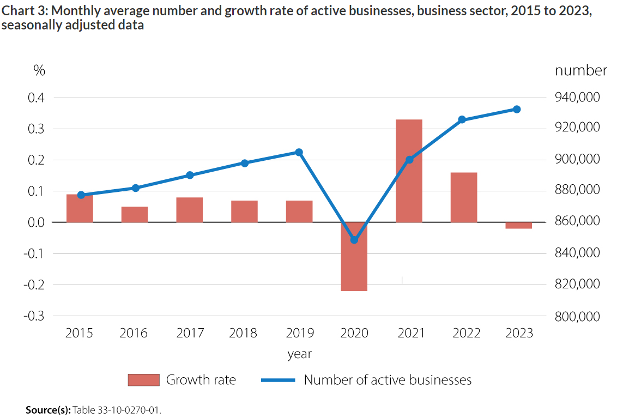

However, more recently, the economic conditions in which businesses are operating have deteriorated. Consider this report from Statistics Canada:

“Except for January and May, the number of active businesses posted either no growth or negative growth in every month of 2023. This was the first year on record that the number of active businesses did not increase for more than three consecutive months, except in early 2020 at the onset of the COVID-19 pandemic. Whether at the provincial or territorial level or across sectors, the number of active businesses declined in most months of 2023.”

The diagram below clearly illustrates the extent the difficulties the pandemic disruption has had on the business ecosystem:

The Bottom Line. The CEI offsets a tax problem for business owners that began with the increase in the capital gains inclusion rate to 66 2/3 on business dispositions. Unfortunately it has likely missed the boat on the real requirements of the business community: struggling entrepreneurs need the help of a team of financial professionals to navigate their way through difficult start up headwinds, help with documentation to access to affordable financing and new investment opportunities. It’s too bad the government isn’t supporting those professional mentors with the CEI, too.