Capital Gains: News on Tax Forms and Changes

Geoff Currier

Say tuned this Friday, January 31 when CRA is set to release its capital gains calculation forms. Will they include the proposed new capital gains inclusion rate calculations? Recall the April 2024 Budget, when our now resigned finance minister Chrystia Freeland announced that the proportion of capital gains that qualify as taxable income would be increased for some tax filers. Is it law? No. What should tax filers do?

The Backdrop. The April budget provisions proposed the new 66 2/3 inclusion rate – an increase from the current 50% - would apply on or after June 25, 2024 to capital gains of more than $250,000 for individual Canadians and to all corporations and most trusts.

This Budget measure – and CRA’s administrative position – would compel Canadians to pay the new capital gains rate when filing 2024 tax returns, even though those changes have not been passed into legislation.

Is the Filing Requirement Legal? Taxpayers are required to self-assess their income according to the object, spirit and intent of the law and face a burden of proof that results in  penalties and interest when there is non compliance.

penalties and interest when there is non compliance.

University of Manitoba Law Faculty Professor Michelle Gallant is an expert in tax law and makes it clear that what CRA is doing “is clearly not law. It’s policy.” Traditionally CRA works under the assumption that a bill will be proclaimed into law once a Ways and Means motion has been tabled in the House of Commons and thus goes ahead with the changes to taxation based on that assumption. In this case, it’s far less clear that capital gains changes will ever become law.

A lawsuit was filed on January 24th by the Canadian Taxpayers Federation on behalf of an Ontario resident challenging the legality of this tax change. The issue is whether or not the federal government can enforce taxation changes on taxfilers without those changes being passed in Parliament.

Further, if they do, it would be important to know where CRA can impose penalties and interest when taxpayers don’t comply with proposed law?

Businesses are left twisting in the taxation winds. Dan Kelly of the Canadian Federation of Independent Business says his members are confused about how these changes have come into effect without an act of Parliament.

“This was in the April budget. They had nine months to pass this into law but did not do it.” Kelly fairly points out that the minister who made the initial announcement resigned and is now running for the Party leadership. Should she win that leadership, Freeland has promised to halt the changes. It’s uncertain what her chief rival, Mark Carney would do if he succeeds Justin Trudeau as Liberal leader.

Kelly says the current finance minister or the Prime Minister could “press pause” on the changes “for the good of the country. Business owners have transactions right now and they don’t have clarity.”

This could all be rendered moot if the government falls upon the resumption of Parliament. If that happens all bills die on the order paper. If not it will be left up to the new Liberal leader to decide what to do about this policy.

In the meantime, it would appear that in an abundance of caution, businesses, individuals and tax experts must all continue working as if the changes to Canada’s capital gains tax system are, and will remain, in place, particularly if the tax forms/CRA assessing softer require the new calculations. It would be recommended to file on time to avoid late filing and gross negligence penalties.

More chaos, different provisions. Another change impacting a greater number of taxpayers is the extension of the deadline to make charitable contributions for the 2024 tax year. Donors may now contribute up to February 28 and apply those donations to the 2024 tax year.

This has also been introduced without any bill being passed into law. But it’s really important to check the fine print in the draft legislation. Specific types of donations will not qualify:

- Gifts that are not in the form of cash or was transferred by way of cheque, credit card, money order or electronic payment

- Gifts that were not made through a payroll deduction, or

- Gifts made by the individuals’ will if the individual died after 2024.

While it may be good news for some looking to reduce their taxable income, the salient point remains that changes to our tax structure are being made without Parliament’s approval, nor did the government allow any feedback on the provisions and the exclusions to them.

Bottom Line. It is quite possible that we may still not have clarity on these and other complex tax changes by the tax filing deadline of April 30. Under those difficult circumstances for taxpayers, it is prudent to advise your clients to proceed under the assumption that they will be required to pay the tax if it applies to them and should the client decide otherwise to protect yourself and your practice with a signed waiver absolving your firm and its tax preparers of the resulting consequences.

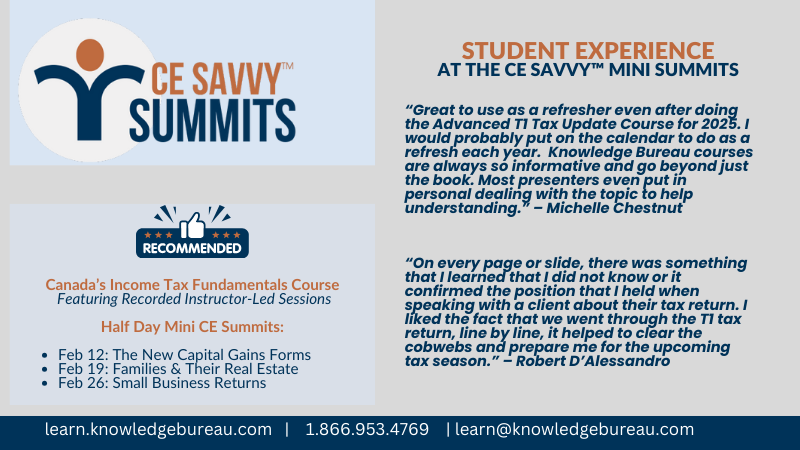

Be sure to join us for a special report on January 31 on the tax forms release and on February 12 for a Mini CE Summit on completing the Capital Gains Forms when there is a sale or deemed disposition of a taxable asset.