Campaign Update: Carbon Taxes And Rebates

Jacks and Currier

Canadians are now into a federal election campaign and tax reductions of all kinds are on the agenda. Prime Minister Mark Carney has already reduced one of the greatest obstacles for the Liberal Party to gain re-election: the consumer carbon taxes as of April 1, 2025. Technically it is being reduced to zero, as without an act of Parliament he cannot eliminate the tax. However, the regulations behind the tax are under the purview of the Finance Minister, and on closer look, we can get a real glimpse of what’s to come should the Liberals win the election.

The Immediate Impact: The Canada Carbon Rebates for consumers and small businesses are ending. Regulations to Schedule 2 of the Greenhouse Gas Pollution Pricing Act (GGPPA) were amended to change the first component of the carbon pollution pricing system (also known as the federal backstop system) to cause the Canada Carbon Tax, now being referred to as the Consumer Carbon Tax) on fossil fuels to zero after March 31, 2025.

So, we’ll see a 17 cent reduction in the price of gas at the pump on April 1. The province of B.C., which levies its own carbon tax system, has also announced this week it is following suit and reducing the tax by the same amount as well.

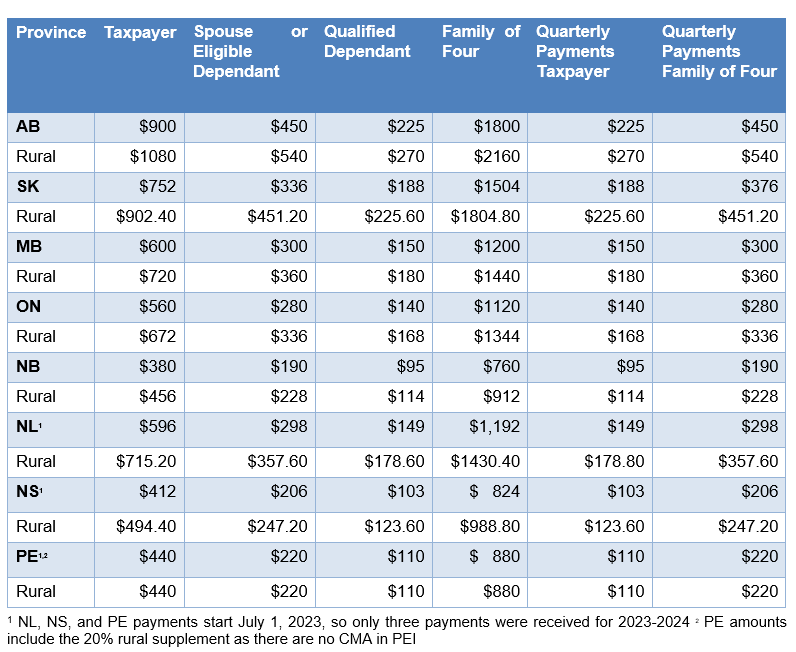

In addition, Canadians who are eligible, can expect to receive their April Canada Carbon Rebate one last time. Here’s what was slated for payment:

The Election Sweetener: The Liberal Leader and current Prime Minister turned the carbon tax rate to zero in his first week in office as prime minister and then announced an election on April 28, two days before the tax filing deadline. Canadians can expect gas and heating prices to go down during the federal election campaign, and still receive the following amounts for the Canada Carbon Rebate for the last time:

Canada Carbon Rebate Amounts 2024-2025

Post Election Realities. This will be happy news for cash flows in April. However, this move will not end the carbon taxes, should the Liberals form the government on April 28. There is more to this story, specifically as it relates to the second component of the tax, the Output-Based Pricing System (OBPS) for large industry.

In a news release issued March 15, the government noted that it is “refocusing pollution pricing on industrial carbon pricing. . .” away from the consumer portion of the tax and towards the federal OBPS, which was designed to create an incentive for industrial facilities from sectors at significant risk of carbon leakage to reduce their emissions per unit of output by putting a price on their pollution.

Carney’s plan is to incentivize individual Canadians to make greener choices. In the news release from his campaign to become Liberal leader he says he’ll “ have “big polluters pay…their fair share for emissions.” As is the case when it comes to phrases like “make the rich pay their fair share,” fair share is never clearly defined.

In the same news release which was issued prior to him winning the Liberal leadership, Carney says,” We will implement policies that are at least as effective in lowering emissions.” Those proposals include “creat(ing) a system of incentives to reward Canadians for making greener choices, such as purchasing an energy efficient appliance, electric vehicle or improved home insulation. The plan will be complemented by measures to invest in energy efficient buildings and electrified transportation.”

The full Carney news release from his leadership campaign can be found here:

https://markcarney.ca/media/2025/01/mark-carney-presents-plan-for-change-on-consumer-carbon-tax

Meanwhile, Pierre Poilievre has said he will do away with all carbon pricing if his Conservatives are elected.

CCR for Small Business to End. Going forward, there would be no new fuel charge proceeds to return to businesses, including through the CCR for Small Businesses, a refundable tax credit that returns a portion of fuel charge proceeds to small and medium-sized businesses based on the number of employees they have.

Impact on Prices? Apart from the obvious relief at the gas pump, though, will Canadians notice any difference in what they pay for groceries or other goods? That’s less likely. The industrial carbon tax is essentially a wholesale tax and unless it is removed, we shouldn’t expect to see a significant reduction in the price of food, clothing, or any other goods we purchase. When industry is charged a tax or is faced with any other increased cost, those costs are always passed on to the consumer. Every time.

Meanwhile, transport companies, manufacturers, small businesses and farmers will continue to pay the carbon tax so not only is it unlikely consumers will see any relief at the cash register as the tax works through supply chains, but worse, Canada may not be that place innovative new companies come to grow in.

Bottom Line: The tariff war will end sooner or later but the issue of carbon pricing in Canada –and our economic growth potential will remain. It would be wise for Canadian voters to pay close attention to what the candidates are promising, as well as the issues they are leaving out. That’s important because it affects our standard of living, the real value of wage increases, after taxes of all kinds.

In short, in this election, astute candidates will be able to connect the dots between taxes, GDP growth and unemployment when they knock on your doors.