Breaking News - Capital Gains Inclusion Rate Increase Postponed to January 1, 2026

Evelyn Jacks

Breaking News - From Finance Canada today - a postponement of capital gains inclusion rate increase from June 25, 2024 to January 1, 2026—the new date on which the capital gains inclusion rate would increase from one-half to two-thirds on capital gains realized annually above $250,000 by individuals and on all capital gains realized by corporations and most types of trusts.

The capital gains exemptions being maintained and created would include the Principal Residence Exemption, the new $250,000 Annual Threshold for Canadians, effective January 1, 2026, and importantly, increasing the Lifetime Capital Gains Exemption to $1.25 million, effective June 25, 2024, from the current amount of $1,016,836 on the sale of small business shares and farming and fishing property.

A new Canadian Entrepreneurs’ Incentive, to encourage entrepreneurship by reducing the inclusion rate to one-third on a lifetime maximum of $2 million in eligible capital gains will take effect in the 2025 tax year and the maximum would increase by $400,000 each year, reaching $2 million in 2029.

In other words, the proposed implementation date for the increase in the Lifetime Capital Gains Exemption and the introduction of the Canadian Entrepreneurs’ Incentive would not change.

Breaking News - From Finance Canada today - a postponement of capital gains inclusion rate increase from June 25, 2024 to January 1, 2026—the new date on which the capital gains inclusion rate would increase from one-half to two-thirds on capital gains realized annually above $250,000 by individuals and on all capital gains realized by corporations and most types of trusts.

The capital gains exemptions being maintained and created would include the Principal Residence Exemption, the new $250,000 Annual Threshold for Canadians, effective January 1, 2026, and importantly, increasing the Lifetime Capital Gains Exemption to $1.25 million, effective June 25, 2024, from the current amount of $1,016,836 on the sale of small business shares and farming and fishing property.

A new Canadian Entrepreneurs’ Incentive, to encourage entrepreneurship by reducing the inclusion rate to one-third on a lifetime maximum of $2 million in eligible capital gains will take effect in the 2025 tax year and the maximum would increase by $400,000 each year, reaching $2 million in 2029.

In other words, the proposed implementation date for the increase in the Lifetime Capital Gains Exemption and the introduction of the Canadian Entrepreneurs’ Incentive would not change.

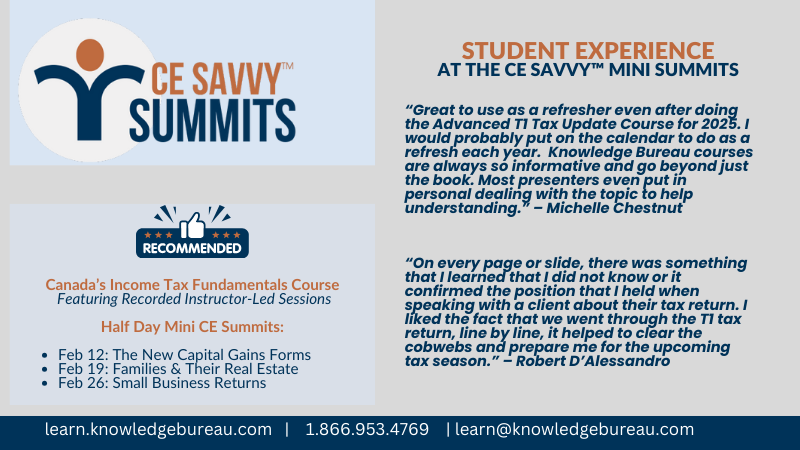

Learn more on February 12 for a Mini CE Summit on completing the Capital Gains Forms when there is a sale or deemed disposition of a taxable asset. Early-bird deadline is February 1!

Check out the details below, and visit the website for the full agenda and event information.

Live Event

Agenda Overview:

- Introduction to Capital Gains Reporting

- Recording Dispositions of Business Properties

- Recording Dispositions of Financial Assets

- Recording Dispositions of Real Estate and Depreciable Property

- Recording Dispositions of Personal Use Properties

- Recording Capital Gains Losses and Carry-Overs

What will you learn?

Learn how to confidently file returns with capital gains transactions based on the latest tax changes for the current tax filing year.

Who is this for? Professionals with experience filing simple personal tax returns. Especially valuable for career development in the tax preparation or financial services industries.

What’s included?

Attend the half-day live-virtual event or watch the recorded sessions, earn 5 CE credits, and automatic enrolment in the 20 hour online certificate program: Canada’s Income Tax Fundamentals Course.

Detailed agenda and registration

Check out all CE Savvy™ Mini Summits - Technical Tax School events coming up this February!