Tax Tip: The More Obscure Medical Expenses

Are you claiming all the medical expenses you or your clients might be entitled to?The Evolution of Bookkeeping Has Come A Long Way

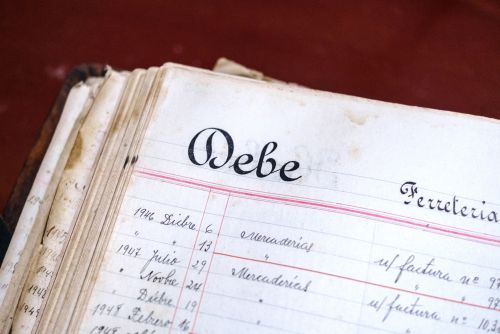

The first ‘record’ of accounting dates back as early as the Mesopotamian civilization, where simple documentation was maintained in the books. Around the 15th century, an Italian monk named Luca Pacioli, considered the father of accounting, developed the double-entry bookkeeping system, which changed the accounting landscape completely. The evolution of bookkeeping has a come a long way from the 15th century when accounting ledgers were completed by hand, compared to today’s digitized process.

The first ‘record’ of accounting dates back as early as the Mesopotamian civilization, where simple documentation was maintained in the books. Around the 15th century, an Italian monk named Luca Pacioli, considered the father of accounting, developed the double-entry bookkeeping system, which changed the accounting landscape completely. The evolution of bookkeeping has a come a long way from the 15th century when accounting ledgers were completed by hand, compared to today’s digitized process.

Canadians “Guessing” Their Way into Retirement

CIBC’s latest annual Financial Priorities poll holds some disturbing revelations. When survey respondents were asked how they are determining how much money they will need to retire:

A shocking 33% indicated they are using their “best guess” and only 14% indicated they are arriving at a number with the help of an advisor.

CIBC’s latest annual Financial Priorities poll holds some disturbing revelations. When survey respondents were asked how they are determining how much money they will need to retire:

A shocking 33% indicated they are using their “best guess” and only 14% indicated they are arriving at a number with the help of an advisor.