New Tax Changes for Caregivers: Alberta Budget

Alberta Finance Minister Nater Horner delivered his second consecutive deficit budget on February 26. The deficit is large at $9.4 billion, which the government attributes largely to declining oil revenues. The document is called Fiscal Plan 2026-2029 meaning that this is a three-year fiscal pan, rather than the typical one-year projection.Ontario Registered Pension Plan Postponed

The Ontario government has reversed it's January decision to launch the Ontario Registered Pension Plan (ORPP) in January 2017 regardless of what the federal government does with CPP. This week, the Ontario government has announced that it will work together with the federal government to achieve the mutual goal of improving pensions.

The Ontario government has reversed it's January decision to launch the Ontario Registered Pension Plan (ORPP) in January 2017 regardless of what the federal government does with CPP. This week, the Ontario government has announced that it will work together with the federal government to achieve the mutual goal of improving pensions.

Max the RRSP Now to Maximize the New CTB

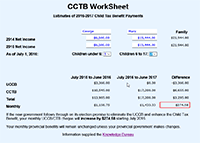

Families who wish to maximize the anticipated new Child Tax Benefit (CTB) for 2016/2017 have less than two weeks left to reduce 2015 net income using an RRSP contribution. The deadline is February 29. For these reasons, Knowledge Bureau has updated its Income Tax Estimator to assist with the calculations.

Families who wish to maximize the anticipated new Child Tax Benefit (CTB) for 2016/2017 have less than two weeks left to reduce 2015 net income using an RRSP contribution. The deadline is February 29. For these reasons, Knowledge Bureau has updated its Income Tax Estimator to assist with the calculations.

Federal Budget: Tax Reforms Coming Soon

A tell-tale sign the federal budget is right around the corner was the February 12 meeting of the Finance Minister with private sector economists for their forecasts on the Canadian and global economies. This this year, a number of significant tax changes are expected, if the newly elected Liberal government’s election platforms are implemented.

A tell-tale sign the federal budget is right around the corner was the February 12 meeting of the Finance Minister with private sector economists for their forecasts on the Canadian and global economies. This this year, a number of significant tax changes are expected, if the newly elected Liberal government’s election platforms are implemented.

Canada and Switzerland Agree to Jointly Fight Tax Evasion

On February 5, the Finance Minister announced that Canada and Switzerland have signed a Joint Declaration which will see the two countries exchange financial account information automatically. With this agreement, CRA expects to curb tax evasion by Canadian residents who earn income in Switzerland but do not report it on their Canadian tax returns.

On February 5, the Finance Minister announced that Canada and Switzerland have signed a Joint Declaration which will see the two countries exchange financial account information automatically. With this agreement, CRA expects to curb tax evasion by Canadian residents who earn income in Switzerland but do not report it on their Canadian tax returns.

It’s Complicated: New T657 Lifetime Capital Gains Deduction Form

CRA has released a newly revised 9-page form T657, which takes into account the increase of the Lifetime Capital Gains Deduction (LCGD) to $1 Million for Qualified Farming and Fishing Properties for dispositions after April 20, 2015 and to $813,600 for Qualified Small Business Corporation Shares for tax year 2015. It can safely be said this form is not for the faint of heart.

CRA has released a newly revised 9-page form T657, which takes into account the increase of the Lifetime Capital Gains Deduction (LCGD) to $1 Million for Qualified Farming and Fishing Properties for dispositions after April 20, 2015 and to $813,600 for Qualified Small Business Corporation Shares for tax year 2015. It can safely be said this form is not for the faint of heart.