This Month’s Poll

Do you enjoy reading breaking tax and financial news in Knowledge Report? Please tell us why/why not?Sharing the Love: Announcing the Gratitude Contest Winner & Your Valentine’s Day Gift

The news is big: first, we are delighted to announce the winner of a free registration to The DAC Acuity Conference in Niagara Falls this October 28-30. Next, we have a Valentine’s Day gift for you! And last but not least, something to make you smile: check out the DAC photo gallery of the highly successful 2019 DAC in Puerto Vallarta. Guess who had the most fun?

The news is big: first, we are delighted to announce the winner of a free registration to The DAC Acuity Conference in Niagara Falls this October 28-30. Next, we have a Valentine’s Day gift for you! And last but not least, something to make you smile: check out the DAC photo gallery of the highly successful 2019 DAC in Puerto Vallarta. Guess who had the most fun?

Charitable Donations by Will: Income or Capital?

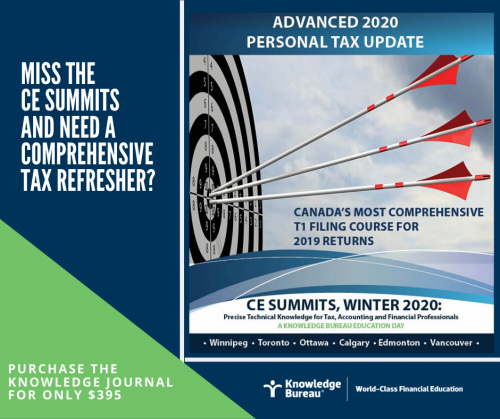

Last week at the CE Summits in Vancouver, an interesting question arose with regards to the deductibility of gifts left by a deceased taxpayer to a specific charity in his will. Would that specific bequest qualify for the donations tax credit on the final return, a trust return or both? It turns out, the answer may be neither.

Last week at the CE Summits in Vancouver, an interesting question arose with regards to the deductibility of gifts left by a deceased taxpayer to a specific charity in his will. Would that specific bequest qualify for the donations tax credit on the final return, a trust return or both? It turns out, the answer may be neither.