The Importance of Provincial Budgets: Elbows Up and No Bracket Creep!

Some of the right things are happening in Nova Scotia, from the perspective of improving standards of living in that province. And that’s important news because according to the Fraser Institute, Canadians have suffered the worst five-year decline in their standard of living over the 2020-to-2024 period since the Great Depression. It notes, our Gross Domestic Product (GDP) per person decreased by 2.0% (0.4% annually) ; this despite aggregate GDP growth of 1.5% over the period. Further, all ten provinces are experiencing stagnation, which is unique in our history. So what’s the good news in Nova Scotia, at this critical juncture?May 18 CE Summit: Eight Topics You Can’t Afford to Miss

The agenda is packed full of vital information tax and financial planning specialists need to know as we round out tax seasons 2022 and begin to plan to reduce taxes and build wealth this year and beyond. The eight critical topics we have chosen for your May CE Summit provide cutting edge professional development to help beat your competition, bring high value to your clients and earn CE Credits too. Register before May 17 to hear Canada’s best-selling financial authors and educators discuss:

The agenda is packed full of vital information tax and financial planning specialists need to know as we round out tax seasons 2022 and begin to plan to reduce taxes and build wealth this year and beyond. The eight critical topics we have chosen for your May CE Summit provide cutting edge professional development to help beat your competition, bring high value to your clients and earn CE Credits too. Register before May 17 to hear Canada’s best-selling financial authors and educators discuss:

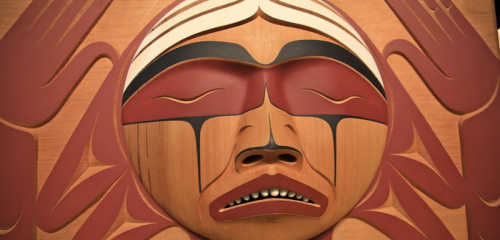

Bank of Canada to Chair the Central Bank Network for Indigenous Inclusion

Did you know that The Central Bank Network for Indigenous Inclusion was established in 2021 by the Bank of Canada, the Reserve Bank of New Zealand, the Reserve Bank of Australia and the U.S. Federal Reserve to foster ongoing dialogue and raise awareness of Indigenous economic and financial issues? Learn more about its mission and why it’s important.

Did you know that The Central Bank Network for Indigenous Inclusion was established in 2021 by the Bank of Canada, the Reserve Bank of New Zealand, the Reserve Bank of Australia and the U.S. Federal Reserve to foster ongoing dialogue and raise awareness of Indigenous economic and financial issues? Learn more about its mission and why it’s important.

Availability of Confidentiality Orders from the Tax Court of Canada

A reassessment following an audit from the CRA is deemed valid and binding subject to being proved incorrect by the taxpayer on a balance of probabilities (above 50%). In order to prove that the reassessment is inaccurate, the taxpayer may have to disclose confidential or otherwise privileged corporate documentation at trial. However, these documents can be accessed by corporate competitors by searching the Court Registry at the Tax Court of Canada.

A reassessment following an audit from the CRA is deemed valid and binding subject to being proved incorrect by the taxpayer on a balance of probabilities (above 50%). In order to prove that the reassessment is inaccurate, the taxpayer may have to disclose confidential or otherwise privileged corporate documentation at trial. However, these documents can be accessed by corporate competitors by searching the Court Registry at the Tax Court of Canada.

Succession Plan Start-Up: An 18-Point Checklist

A financial plan matters, a lot. Yet, close to 50% of Canadians don’t even have a budget. Further, only about 30% of Canadians knew what a financial plan is and how it could help them. That means there is a lot of potential for collaboration to get better financial results and achieve more financial goals.

A financial plan matters, a lot. Yet, close to 50% of Canadians don’t even have a budget. Further, only about 30% of Canadians knew what a financial plan is and how it could help them. That means there is a lot of potential for collaboration to get better financial results and achieve more financial goals.