Last updated: September 17 2025

October 1 - Important Changes Coming to VDP

Evelyn Jacks

Effective October 1, 2025, important changes will be made to the Voluntary Disclosures Program (VDP) at the CRA in order to make it easier for taxpayers to correct unintentional filing errors or omissions. The details on how the changes will affect your clients are being discussed in the CE Summit held September 17 and this course is now available for online enrolment and CE accreditation, after the virtual event. Here are some highlights of the changes.

Backdrop. First, for Voluntary Disclosures received prior to October 1, 2025, the old rules will apply, as described in IC00-1R6. This describes how to make application and request relief under the General Program (which can grant penalty and some interest relief) or the Limited Program (which can grant penalty but no interest relief).

The government intends to simplify Form RC199, Voluntary Disclosures Program (VDP) Application, after September 30 as well.

After September 30, 2025. The VDP will apply to disclosures relating to income taxes and a variety of other taxes including GST/HST, withholding taxes, luxury taxes and the UHT (Underused Housing Tax).

Possible Relief. Under the newly simplified VDP, three main benefits may be granted:

- penalty relief

- interest relief

- no referral for criminal prosecution for the issue(s) disclosed

New Levels of Relief. Under new rules, VDP applications are eligible for two levels of relief

- general (unprompted) - 75% relief of the applicable interest; 100% relief of the applicable penalties.

- partial (prompted) - 25% relief of the applicable interest; up to 100% relief of the applicable penalties.

- IC00-1R7 emphasizes the CRA’s position on criminal prosecution. A significant benefit of the VDP remains intact: taxpayers who submit valid disclosures under the program will not be referred for criminal prosecution related to the matters disclosed. This incentive, combined with relief from penalties and partial interest, provides a strong motivation for taxpayers to proactively correct past errors or omissions.

No Relief Circumstances. The VDP application must be voluntary to be considered. The application will not be considered voluntary if an audit or investigation has been initiated against the taxpayer or a related taxpayer in respect of the information being disclosed.

Also, it’s interesting to note that audits or investigations are not limited to those conducted by the CRA. They can also be conducted by a law enforcement agency, securities commission, or other federally or provincially regulated authority.

No relief is available in several circumstances including when the VDP application relates to returns resulting in a refund, or with no taxes or penalties owing, or if the taxpayer is seeking relief on existing penalties and/or interest, that have already been assessed by the CRA.

Another important feature of IC00-1R7 is the continued exclusion of anonymous disclosures, which were eliminated in 2018. While some had hoped this option would return, the updated circular maintains that applications must include the taxpayer’s identity. However, pre-disclosure discussions are encouraged, allowing taxpayers or their representatives to engage informally with the CRA to better understand the VDP process, assess eligibility, and gauge the potential benefits of coming forward. These discussions are non-binding but serve as a valuable risk-assessment tool.

Representing a Client. The CRA can only discuss and provide a taxpayer's information to the taxpayer or their authorized representative. But note that if a taxpayer received assistance or advice from an individual (including a tax professional or promoter), the name of that individual must be included in the application form that relates to the disclosure.

Time Lines - Despite the improvements outlined in IC00-1R7, practical challenges remain—particularly regarding processing times. Although the CRA states that VDP applications should be processed within 180 days, actual experiences often differ.

In one case, an application submitted in May 2023 was not resolved until late October 2024, taking 369 days (excluding weekends and holidays). With the application process now becoming simpler and potentially more accessible, questions arise about whether the CRA will be equipped to handle a potential increase in volume efficiently.

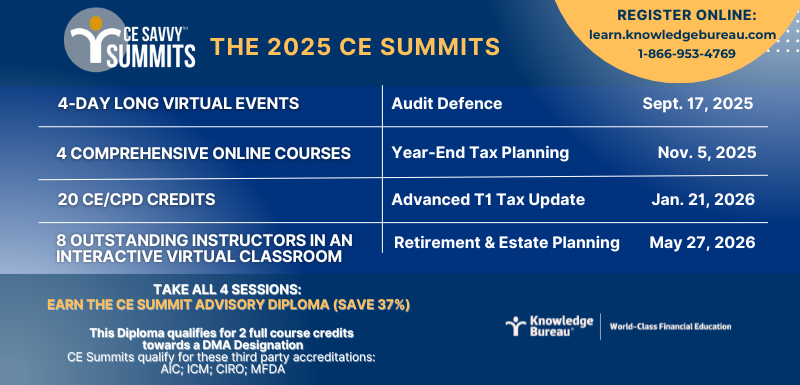

The Bottom Line. This is positive news relating to the simplification of a fairness process that was previously much more difficult to understand. Join us to learn more in the Knowledge Bureau’s 2025 CE Summit - Audit Defence Course, a feature of the Professional Development Division.