Last updated: March 05 2013

Evelyn Jacks: TFSA Analysis Fascinating

According to a new report, the middle class, women, and seniors have been stellar investors in the Tax Free Savings Accounts, amongst the 8.2 million Canadians who opened one up to the end of 2011.

The financial assets held in TFSAs based on the Tax Expenditures and Evaluations 2012 report released last week by the Finance Department was $62Billion. Good on us, Canada!

For the year 2011, the analysis found amongst other things:

- 80% of individuals with incomes under $80,000 accounted for 80% of all TFSA holders and contributions

- 30% of adult tax filers had a TFSA, with a stable participation rate between the ages of 25 to 49, but an increasing rate with seniors.

- Even low income seniors have taken advantage – GIS recipients represent 6% of TFSA holders and their participate rate was 23% -3% higher than that of low income individuals in general!

- The average contribution by a TFSA holder is $3727.

This compares favorably to the average RRSP contribution rate in Canada, which according to a 2012 study by Bank of Montreal was about $4,670 per contributor.

What’s impressive about the TFSA participation rates is that women have embraced them more exuberantly than their male cohorts: 33% vs. 29% for men. Age differences are interesting too. Below age 50 TFSA participation rates peak in the 25-29 age group, declining slightly after this until after age 49 when TFSA participation rises: 28% for 45-49, to 41% for 65-71. Over age 72, TFSA participation declines.

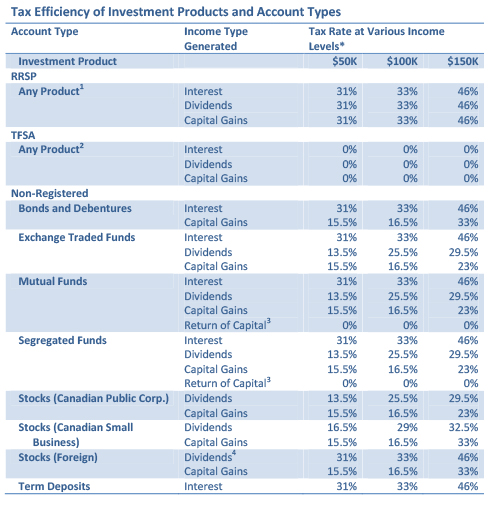

It’s Your Money. Your Life. TFSAs are a great way to avoid high marginal tax rates in retirement and on the final tax return of the deceased taxpayer. Consider the taxing alternative in the chart below, excerpted from Knowledge Bureau’s EverGreen Explanatory Notes:

*2013 rates for residents of Ontario – rounded to the nearest .5%

Notes:

1. All income (plus contributions) is taxed at the taxpayer’s marginal tax rate when removed from the plan. However a tax deduction is allowed for contributions to the plan.

2. All income is tax-free while in the plan and when removed.

3. Return of capital is not taxable when received, but will reduce the ACB of the investment thereby triggering capital gains when the asset is disposed of.

4. Foreign dividends are taxed as ordinary income.

Evelyn Jacks is the best-selling author of 50 books on tax and wealth management and President of Knowledge Bureau. Evelyn's books are available at www.knowledgebureau.com and better bookstores. To read more of her blogs, go to EvelynJacks.com.