Virtual CE Summits

Virtual CES: Jan 17, 2024 Virtual CES: May 22, 2024 Virtual CES November 1, 2023 Virtual CES: September 20, 2023 CE Summits

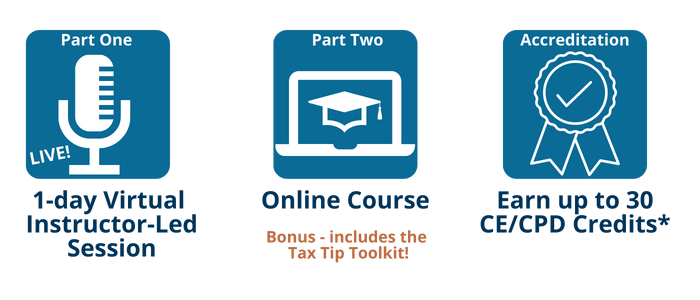

The All New Virtual CE Summits feature two dynamic components:

1. Your Comprehensive Course

2. The Virtual CE Summit Event

Everything is Included:

Comprehensive Online Course

Online Quizzes

Program Guide with Presentations

Certification and Accreditation